Managing your money shouldn’t come with surprise charges or long waits for your paycheck. Yet for many, hidden fees and delayed direct deposits can turn a simple banking experience into a source of stress.

What if you could avoid costly bank fees and access your wages up to two days early? Welcome to the world of zero-fee checking accounts with early direct deposit, where convenience meets empowerment.

Understanding Zero-Fee Checking Accounts

Zero-fee checking accounts are designed to eliminate the monthly maintenance fees that traditionally erode your balance. With these accounts, you can spend, save, and transfer money without worrying about unexpected deductions.

Beyond the absence of monthly charges, many free checking accounts also include perks that help you keep more of your earnings:

- No minimum balance requirement to avoid fees

- ATM fee reimbursements for out-of-network withdrawals

- Overdraft protection to prevent penalty fees

- Cash-back rewards or interest earnings on balances

How Early Direct Deposit Works

Traditional direct deposit processes require the bank to receive and clear funds before you can spend them. Early direct deposit flips this model by granting you immediate access once your employer or benefits provider sends the payment notice.

This innovation relies on banks receiving electronic notifications of incoming funds, allowing them to post your paycheck ahead of schedule. While the exact timing depends on when the payer transmits data, you could see your funds up to two days early—a crucial advantage for anyone living paycheck to paycheck.

The benefits of early direct deposit extend far beyond convenience. By getting paid sooner, you can:

- Build better budgets and pay bills on time

- Handle unexpected expenses without resorting to high-interest loans

- Improve cash flow for freelancers and gig workers

Top Zero-Fee Checking Accounts for 2025

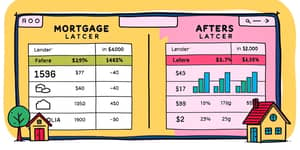

As banking solutions evolve, a handful of providers stand out for combining true fee-free checking with early direct deposit. The following table highlights key features of leading accounts in 2025:

Additional Tools & Benefits

Free checking accounts often come with modern digital tools that support your financial journey. Robust mobile apps enable features like mobile check deposit, real-time spending alerts, and the ability to freeze or unfreeze your cards instantly.

Some banks go further by offering:

- Educational resources to improve financial literacy

- Credit-building tools that report on-time payments

- FDIC or NCUA insurance for deposit protection

Choosing the Right Account for You

With so many options available, selecting the best account depends on your individual needs and lifestyle. Consider these factors:

- Your average monthly balance and whether you value interest earnings

- Frequency of ATM use and reimbursement limits

- Dependence on early paycheck access for budgeting

- Eligibility requirements for sign-up bonuses or direct deposit perks

Review each institution’s policies on foreign transactions, wire transfers, and potential non-sufficient funds protocols to ensure there are truly no hidden charges.

Taking Charge of Your Financial Future

Zero-fee checking accounts with early direct deposit represent more than just a banking choice—they symbolize a step toward financial stability and autonomy. By embracing these modern solutions, you reclaim control over your cash flow, reduce reliance on costly credit, and pave the way for smarter savings.

Opening a new account is straightforward. Gather your personal information, set up qualifying direct deposit with your employer or benefits provider, and watch as your banking experience transforms. Within days, you could be enjoying seamless mobile banking experience and funds landing in your account before you expect them.

Empower yourself with the tools and services that respect your hard-earned money. Switch to a zero-fee checking account with early direct deposit today, and join the growing number of individuals who are maximizing their savings and minimizing financial stress.

References

- https://www.nerdwallet.com/best/banking/free-checking-accounts

- https://personal.chase.com/personal/secure-banking

- https://www.bankofamerica.com/deposits/checking/advantage-banking/

- https://www.bankrate.com/banking/checking/best-free-checking-accounts/

- https://www.businessinsider.com/personal-finance/banking/best-free-checking-accounts

- https://www.chase.com/personal/banking/education/basics/early-direct-deposit

- https://www.capitalone.com/bank/disclosures/checking-accounts/online-checking-account/

- https://www.pnc.com/en/personal-banking/banking/checking.html