Building a robust emergency fund is one of the most empowering financial moves you can make. In an unpredictable world, having ready cash set aside offers peace of mind, shields you from debt, and keeps you on track toward your long-term goals.

In this guide, we explore the best accounts for your emergency savings, explain why they matter, and share proven strategies to help your fund grow steadily in 2025.

Why an Emergency Fund Matters

Life is full of surprises: a sudden job loss, an unexpected medical bill, or urgent home repairs can arise at any moment. Without savings, you may resort to high-interest debt or drain long-term investments, jeopardizing your financial stability.

By setting aside money exclusively for emergencies, you create a protective buffer that absorbs shocks and preserves your progress on other goals—whether saving for retirement, buying a home, or planning a dream vacation.

Recommended Emergency Fund Size

Experts generally agree that your emergency fund should cover three to six months of essential living expenses. For instance, if you spend $3,000 monthly, aim for a balance between $9,000 and $18,000.

Individual circumstances can shift this target:

- Self-employed professionals may need up to nine months of cash saved.

- Families with school-age children often prefer six to twelve months to account for variable costs.

- Anyone facing upcoming life changes—like a move or career switch—should consider a larger cushion.

Adjust your goal as your life evolves. A dynamic fund reflects your current needs and future uncertainties.

Top Financial Products for Your Fund

Choosing the right account is critical. The ideal vehicle combines safety, liquidity, and competitive yield so your money grows while remaining accessible when you need it most.

- High-Yield Online Savings Accounts – FDIC-insured up to $250,000, these accounts offer APYs above 4%, far outpacing traditional banks.

- Money Market Accounts – Blend checking features with attractive rates; many include debit cards and check-writing for easy access.

- Cash Management Accounts – Offered by brokerage firms, these accounts often provide expanded insurance coverage and seamless integration with investment portfolios.

- Short-Term Certificates of Deposit (CDs) – Lock in higher rates with 90- or 180-day terms; ideal for a portion of your fund if you can stagger maturity dates.

- Traditional Bank/Credit Union Savings – Keep a small portion here for immediate, in-branch withdrawals, though yields tend to be lower.

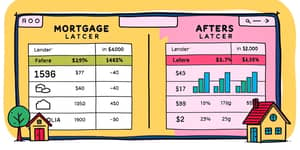

Below is a snapshot of current APYs in May 2025:

Products to Avoid for Emergencies

While tempting, these options can leave you stranded when urgency strikes:

- Stocks or equity mutual funds – Markets can swing dramatically on short notice.

- Real estate or rental properties – Illiquid and time-consuming to convert to cash.

- Long-term bonds or retirement accounts – Withdrawals may incur penalties and taxes.

Stick with accounts designed for quick access and guaranteed principal protection.

Key Considerations When Choosing an Account

Three pillars underpin every great emergency savings vehicle:

Safety through insurance protection – Verify FDIC or NCUA coverage up to $250,000 per depositor, per institution.

Liquidity and easy withdrawals – Look for accounts with no or minimal withdrawal penalties, and check transfer times so you’re prepared when emergencies hit.

Interest rates that beat inflation – Current savings rates surpass the 2.9% December 2024 inflation, helping maintain your purchasing power over time.

Strategies to Build Your Emergency Fund

Consistency and automation are your best allies. Consider these steps:

- Set up direct deposit splits that funnel a portion of each paycheck into your emergency account automatically.

- Allocate windfalls—tax refunds, bonuses, or gifts—directly into your fund to accelerate growth.

- Keep your emergency fund separate from daily spending accounts to prevent accidental withdrawals and maintain discipline.

Tracking progress in a budgeting app or spreadsheet keeps you motivated. Celebrate milestones—hitting one month, three months, then six months of coverage—to reinforce positive habits.

Beyond Savings: Building Confidence and Knowledge

Studies reveal that owning a savings account and feeling financially confident boost the likelihood of having a well-funded emergency account. Enhance your financial literacy by:

• Reading reputable personal finance blogs and books

• Attending webinars on budgeting and saving

• Seeking guidance from certified financial planners when in doubt

Empowered with knowledge and solid habits, you’ll be less likely to dip into investments or carry high-interest debt when surprises arise.

Conclusion: Your Roadmap to Resilience

An emergency fund is more than a safety net—it’s a foundation for freedom. By choosing the right products, automating savings, and continually educating yourself, you create unshakable financial security.

Begin today: assess your expenses, select an account with a competitive APY, and commit to regular contributions. The peace of mind you gain will ripple through every aspect of your life, empowering you to weather any storm with confidence.

References

- https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.myfmbank.com/blog/post/how-to-grow-an-emergency-fund

- https://www.bankrate.com/banking/savings/where-to-keep-emergency-fund/

- https://investor.vanguard.com/investor-resources-education/emergency-fund/why-you-need-one

- https://pmc.ncbi.nlm.nih.gov/articles/PMC7236434/

- https://www.mintos.com/blog/how-to-build-an-emergency-fund/

- https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/