In today’s fast-paced world, finding effortless ways to save can feel like an impossible quest. What if your everyday purchases could turn into a steady stream of savings or investments? Thanks to fintech innovation, round-up savings tools are making that dream a reality.

What Are Round-Up Savings Tools?

Round-up savings tools are digital financial products—offered by banks and standalone apps—that automatically round up purchases to the nearest dollar (or local currency). The spare change from each transaction is transferred into a savings or investment account, helping users save without changing daily habits.

Whether you’re a casual spender or a high-frequency shopper, these tools work in the background. You link a credit or debit card to the platform, and every time you swipe, the app takes the difference between the purchase amount and the next dollar, routing it into your designated fund.

How Round-Up Savings Work

The mechanics of round-up tools are straightforward, yet their impact can be profound over time:

- Each purchase is rounded up to the nearest dollar.

- The app transfers the difference into a savings or investment account.

- Transfers can happen immediately after each transaction or when accumulated rounding reaches a threshold (e.g., $5).

- Some platforms offer multiplication or manual round-ups for accelerated saving.

Imagine purchasing a coffee for $3.45. The app rounds your spend up to $4.00, moving 55 cents to your savings. A quick lunch costing $8.20 generates 80 cents more. Over weeks and months, those cents add up to real dollars.

Popular Apps Comparison

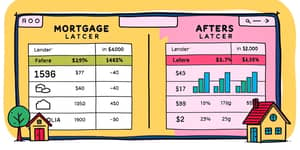

Choosing the right round-up tool depends on your goals—whether saving cash or investing in markets. Below is a comparison of leading apps and their standout features:

Each platform offers unique perks—Acorns is ideal for passive investors, while SoFi appeals to those seeking a holistic banking relationship. Evaluate fees, transfer thresholds, and investment options before committing.

Benefits of Round-Up Tools

Micro-saving strategies harness the power of small amounts. Key advantages include:

- Effortless habit formation: Savings pull happens automatically, requiring no extra effort.

- Visible progress: Watching a balance grow in app dashboards fuels motivation.

- Compounding potential: When spare change is invested, returns multiply over time.

- Customizable saving pace: Multiply or toggle round-ups on select transactions.

By making saving frictionless, users often amass over $500 annually, even with moderate spending. For those making 30 transactions per week, typical tools can generate savings north of $520 each year.

Drawbacks and Considerations

No financial tool is without caveats. Consider these factors before diving in:

- Monthly fees can erode small balances, especially for light spenders.

- Infrequent card users will see minimal growth.

- Privacy concerns arise when linking bank accounts to third parties.

- Round-ups alone won’t replace a robust emergency fund or retirement plan.

Always review an app’s fee schedule and security protocols. Pair round-up tools with traditional savings methods for well-rounded financial health.

Maximizing Your Round-Up Savings

To extract the full potential of these platforms, consider the following strategies:

- Enable both automatic and manual round-ups to maintain control over your pace.

- Use amplification features where available, such as 2x or 3x multipliers.

- Set savings milestones within the app and celebrate each achievement.

- Review your spending habits monthly to ensure you’re maximizing the tool’s benefits.

Pair your round-up app with budgeting software or spreadsheets to track overall progress. Combining insights from multiple tools will give you a clearer picture of spending patterns and savings opportunities.

Embracing a New Savings Habit

Round-up savings tools do more than accumulate spare change; they foster a mindset shift. By automating your savings, you build financial discipline effortlessly. Over time, this transforms your spending habits and creates a buffer for unexpected expenses.

You might start with just a few dollars saved each week, but as your balance grows, you’ll gain confidence to explore other investing avenues or increase your contribution rates. Today’s spare change could be tomorrow’s emergency fund or a down payment on your dream home.

In closing, round-up savings tools offer a blend of psychology, technology, and convenience that can revolutionize personal finance. Whether you’re a savings novice or an investing veteran, these platforms provide an accessible entry point to build wealth. Take the first step now—link a card, set your preferences, and watch how small actions generate lasting impact.

References

- https://www.nasdaq.com/articles/7-best-round-up-apps-for-saving-investing-money-instantly-0

- https://www.sofi.com/learn/content/what-are-round-up-savings/

- https://www.gobankingrates.com/saving-money/savings-advice/how-rounding-up-your-purchases-can-turn-pennies-into-dollars-without-using-an-app/

- https://www.acorns.com/round-ups/

- https://www.moneylion.com/learn/what-are-round-ups/

- https://moneywise.com/banking/banking-reviews/round-apps-savings-apps

- https://www.gsa.gov/buy-through-us/purchasing-programs/multiple-award-schedule

- https://www.moneyboxapp.com/faqs/how-do-round-ups-work-2/