Accumulating debt can feel overwhelming, but with a clear plan and proven methods, you can regain control and move toward financial freedom quickly.

Understanding the two strategies

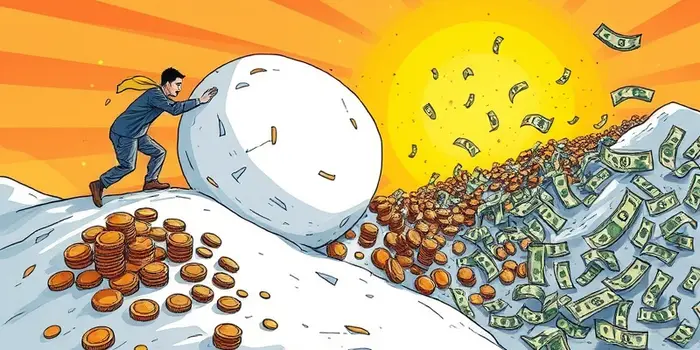

Before diving into payment plans, it’s important to grasp the core principles of the debt snowball and debt avalanche methods. Both approaches rely on consistent payments and prioritization, yet they emphasize different goals and psychological factors.

The snowball method focuses on paying off your smallest balances first. This creates momentum through early victories, fueling motivation to tackle larger debts.

In contrast, the avalanche method targets debts with the highest interest rates. By addressing expensive debts first, you minimize total interest paid over the life of your loans and save money.

Comparing snowball and avalanche

This table highlights why someone might choose one method over the other. If you need an early sense of accomplishment, the snowball method can deliver psychological boost and quick wins. Meanwhile, the avalanche method appeals to those who want to be strategically minimize interest costs.

Pros and cons of each approach

Every method has its advantages and trade-offs. By weighing these pros and cons against your personality and financial situation, you can make an informed choice.

- Pros of Snowball: Quick momentum, simple ordering, works for diverse balances.

- Cons of Snowball: May pay more interest overall, high-rate debts linger.

- Pros of Avalanche: Maximizes interest savings, efficient use of payments.

- Cons of Avalanche: First payoff may take long, demands strict consistency.

Real-world numbers and outcomes

Numbers can bring these concepts to life. Imagine you owe three loans:

- Loan A: $10,000 at 3%

- Loan B: $20,000 at 20%

- Loan C: $100,000 at 6%

Using the snowball method, you would tackle Loan A first, then Loan B, then Loan C. This path might take around ten years and cost roughly $51,000 in interest, saving about $6,240 compared to minimum payments.

On the other hand, the avalanche method begins with Loan B at 20%. By cutting high interest early, you can reduce total interest paid to around $14,000 and finish payments in 28 periods, compared to 30 for the snowball in similar scenarios. These figures illustrate how strategy selection affects your financial journey.

Choosing the right strategy for you

Your unique profile plays a central role in deciding which path to follow. Consider these factors:

Motivation vs. savings: If you need to see quick progress, the snowball method’s small victories can be invaluable. For those who can sustain focus without immediate wins, the avalanche delivers long-term financial efficiency.

Discipline: Avalanche requires strict commitment, as results may not appear instantly. Snowball provides more frequent payoffs, making it easier to stick with the plan.

Debt profile: Multiple small balances favor snowball. Large, high-interest debts are best handled with avalanche.

Implementing your chosen plan

To put either strategy into action, follow these key steps:

- List all debts by balance and interest rate to create transparency.

- Make minimum payments on all accounts except your target debt each month.

- Allocate extra funds to either the smallest balance (snowball) or highest rate (avalanche).

- Once a debt is paid, roll freed-up payments forward to the next prioritized debt.

- Repeat this cycle until you achieve zero debt.

Additional tips for staying on track

- Track your progress visually with charts or apps to maintain motivation.

- Celebrate milestones—once you clear a debt, reward yourself in a small way.

- Adjust your budget if extra money becomes available for faster payoff.

- Automate payments to avoid missed due dates and late fees.

- Seek support from communities or accountability partners.

Conclusion

Whether you embrace the snowball or avalanche method, the key is consistency and focus. By prioritizing your debts and committing to a structured payoff path, you move steadily toward financial freedom.

Remember that every payment brings you closer to a debt-free life. Choose the method that aligns with your temperament and goals, and stay disciplined. With determination and the right strategy, you can conquer your debts faster than you ever thought possible.

References

- https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/snowball-vs-avalanche-paydown/

- https://www.experian.com/blogs/ask-experian/avalanche-vs-snowball-which-repayment-strategy-is-best/

- https://www.fidelity.com/learning-center/personal-finance/avalanche-snowball-debt

- https://www.investopedia.com/articles/personal-finance/080716/debt-avalanche-vs-debt-snowball-which-best-you.asp

- https://www.navyfederal.org/makingcents/credit-debt/snowball-vs-avalanche-for-paying-down-debt.html

- https://www.businessinsider.com/personal-finance/investing/debt-snowball-vs-debt-avalanche

- https://commons.lib.jmu.edu/cgi/viewcontent.cgi?article=1672&context=honors201019

- https://www.thrivent.com/insights/budgeting-saving/debt-snowball-vs-avalanche-choosing-the-right-debt-payoff-method